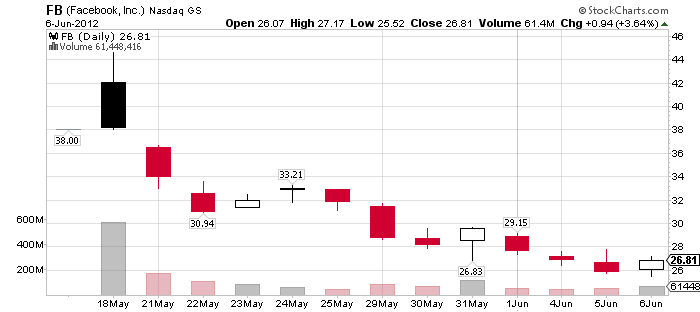

【古风按】脸书(Facebook: FB)自从5月18日开始上市以来,已经从每股38美元的初始上市价格(上市当天最高股价曾达到45美元)下跌到了27美元以下了。如此热炒的IPO的股价竟然呈现出几乎直线坠落的状态基本上是绝无仅有的“黑天鹅”事件,一时间网络上就传开了所谓的阴谋论:大的买家通过NASDAQ交易所的技术故障压低了脸书的股价,好买入尽量多的股份。事实真相是如此吗?古风不同意这样的见解。原因何在?如果大的买家真的想积累尽量多的股份,为何在股价直线下跌的过程中,他们不多买进呢?而事实上,除了第一天的交易量超过了5.7亿股和第二天的近1.7亿股以外,每天成交量几乎都没有再高出1亿股了。这明显地说明大买家在IPO后根本就没有入场买股。恰恰相反,脸书的股价与成交量数据表明自从IPO以来,基本上是卖方市场,脸书的股价一直承受着巨大的卖压,事实上大卖家在持续卖股。了解了这一点,我们就可以来谈论一下“脸书的股价还有多大的下跌空间”的课题了。首先,大家需要牢记一个关键的数据:脸书的每股盈利(EPS)只有39美分,如果按照脸书的IPO起始价(每股38美元),它的市盈率(P/E)有近100倍;如果按照IPO当天的最高价(45美元),其市盈率竟然超过了115倍!即便从最高价已经下跌了40%,现在的市盈率仍然接近70倍。大家如果把脸书的市盈率跟苹果(AAPL)的14倍和谷歌(GOOG)的17倍做一下对比,就会发现脸书的股价还是太高啦!古风断言市场最终会把脸书的股价拉回到市盈率14-17倍的区间,这就是说其股价会继续巨幅下堕,直到每股6美元左右(IPO起始价的15%,最高价的13%,今天收盘价的22%)。当然,古风的预计还算是保守的,如果按照John Azis的推算,脸书最终仅有每股2-4美元(见下附录英文资料)。因此,古风规劝买入了脸书的网友早点逢高卖出,不要当最后接手雷的那个人啦。

【相关阅读】古风解读《股市崩盘五部曲》

http://blog.wenxuecity.com/myblog/46947/201204/204.html

古风解读美国未来的经济与股市行情

http://blog.wenxuecity.com/myblog/46947/201203/21036.html

古风解读摩根大通巨亏20亿美元交易的内幕

http://blog.wenxuecity.com/myblog/46947/201205/13383.html

古风再次解读摩根大通衍生品交易的巨额亏损

http://blog.wenxuecity.com/myblog/46947/201205/24047.html

http://azizonomics.com/2012/05/31/facebook-the-bubble-mentality/

Facebook & the Bubble Mentality

by John Azis, Azizonomics, 31 May 2012

So Facebook keeps falling, and is now floating around the $27 mark. We’re a third of the way down to my IPO valuation of FB as worth roughly $2-4 a share (or 5-10 times earnings), although I wouldn’t be surprised for the market to stabilise at a higher price (at least until the next earnings figures come out and reveal — shock horror — that Facebook is terrible at making money).

The really stunning thing is that even after all these falls, FB is still trading at 86 times earnings. What the hell did Morgan Stanley think they were doing valuing an IPO without any viable profit model at over 100 times earnings? The answer is that this was an exit strategy. This IPO was about the people who got in early passing on a stick of dynamite to a greater fool which incidentally is precisely the same bubble mentality business model as bond investors who are currently buying negative-real-yielding treasuries at 1.6% hoping to pass them onto a greater fool at 0.5% (good luck with that).

This was achieved by convincing investors to ignore actual earnings and instead focus on projected future earnings. From Bloomberg:

Facebook, with a market capitalization of $79.1 billion, is trading at 29.5 times the company’s projected 2014 profit of $2.69 billion, data compiled by Bloomberg show.

Or much more simply, counting chickens before they hatch.

There’s an interesting comparison to the development of AAPL. Steve Jobs — who went on to do great things — was never fully in charge of AAPL until much later on. AAPL externally recruited CEOs with business experience, and Jobs was eventually thrust out of the company he founded, to continue his journey on his own. Failure is a really valuable lesson. Jobs was lucky to experience it and learn from it early before he ever got a chance to destroy AAPL.

FB isn’t really a bad business, and prospects would look much rosier if it were priced more realistically. It’s generating a profit — just a much smaller one than suggested by the IPO pricing. And management are being swept along by everyone else’s irrational euphoria. Zuckerberg can freely throw away a whole year’s earnings buying Instagram — an App whose functionality FB actually duplicated in-house almost certainly for a tiny fraction of the cash thrown at Instagram. And Zuckerberg — who controls a majority of the voting rights — isn’t going to get thrust out into the cold by shareholders. He can keep wildly throwing cash around so long as it keeps flowing into FB. The problem is, given the steep price falls, it looks like the river is running dry.

As I wrote before FB started falling:

The big money coming into Facebook just seems to be money from new investors — they raised eighteen times as much in their flotation yesterday as they did in a whole year of advertising revenue. For an established company with such huge market penetration, they’re veering dangerously close to Bernie Madoff’s business model.

That’s life. Bubbles get burst; the Madoff bubble, the securitisation bubble, the NASDAQ bubble, the housing bubble, the Facebook bubble, the treasury bubble. The trick is not getting swept up by the irrational euphoria. Better to miss a blow-out top than to end up holding a stick of dynamite.