岁月静好

凡所有相,皆是虛妄,若見諸相非相,則見如來Best & Worst S&P 500 Sectors of 2023

We are looking at the best and worst performing sectors and stocks of the S&P 500 in 2023. Which stocks outperformed in 2023?

- The S&P 500 is a stock market index that's widely considered the benchmark for stock market performance year over year.

- The S&P 500 is up over 20% year-to-date in 2023.

- The best performing sector in the S&P 500 this year was technology.

- The worst performing sector in the S&P 500 this year was utilities.

What is the S&P 500?

The S&P 500, otherwise known as the Standard and Poor's 500, is a stock market index that tracks the performance of the 500 largest companies listed on stock exchanges in the United States.

Many consider the S&P500 the "benchmark" of stock market performance year to year, simply because it encompasses so many different sectors. Unlike the Nasdaq, which is primarily tech and growth stock exposure, the S&P 500 ranges from energy, to healthcare, to financial, and even real estate sectors.

The S&P 500 can be directly traded with the S&P 500 ETF (SPY), the S&P 500 e-mini futures (/ES), or the cash-settled S&P 500 Index (SPX).

What sectors make up the S&P 500?

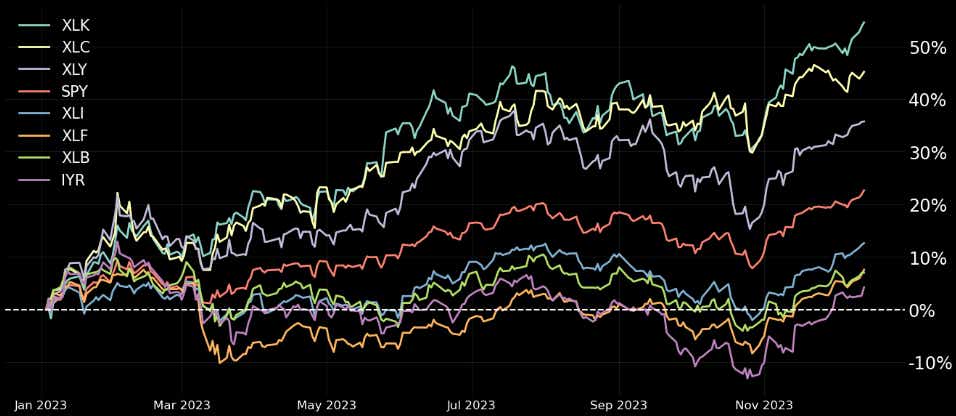

There are 11 sectors in the S&P 500, which is why there is such balanced exposure relative to other indices that are more condensed in market exposure. The chart below highlights the year-to-date (YTD) performance of each sector's ETF, in order of best performing to worst performing sector.

The S&P 500 ETF (SPY) is on the chart to show relative strength for other sectors—the ETF is right in the middle of the pack relative to other specific sectors it contains.

Bullish sectors

XLK - Technology

The technology sector is up over 50% for the year to date, with the surge in AI demand, as well as strong earnings growth from some of the magnificent seven stocks—Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT). We can't forget about Adobe (ADBE), who reports earnings on Dec. 13 after the market closes. These high-flying tech stocks have greatly contributed to the overall performance of the S&P 500 in 2023.

XLC - Communications

The communications sector is up over 40% YTD, with stocks such as Meta (META), Google (GOOGL), and Netflix (NFLX) leading the charge for the S&P 500 communications gains on the year.

XLY - Consumer discretionary

The consumer discretionary sector is up over 30% YTD. This sector includes products like Amazon (AMZN), McDonalds (MCD), Home Depot (HD), and Lowe's (LOW).

XLI - Industrial

The industrial sector is up over 10% YTD, and includes companies like General Electric (GE), Boeing (BA), Caterpillar (CAT), and United Parcel Service (UPS).

XLF - Financial

The financial sector is up just under 10% YTD and includes your classic banking and finance companies like JPMorgan Chase (JPM), Visa (V), Mastercard (MA), and Bank of America (BAC).

XLB - Materials

The materials sector is up just under 10% YTD, and this sector includes companies like Linde PLC (LIN), Sherwin-Williams (SHW), Air Products & Chemicals (APD), and Freeport-McMoRan (FCX).

IYR - Real Estate

The real estate sector is the final S&P 500 sector that posted a gain of about 5% in 2023 so far. This sector includes companies like Prologis (PLD), American Tower Corp (AMT), and Equinix (EQIX).

Bearish sectors

XLV - Healthcare

The healthcare sector has had a choppy 2023 and is the first S&P 500 sector that has a loss of just under 5% so far in 2023. This sector contains companies like UnitedHealth Group (UNH), Eli Lilly and Co (LLY), Johnson & Johnson (JNJ), and Merck (MRK).

XLE - Energy

The energy sector has dipped into the red in the past few months with the big selloff in Oil and Natural Gas products. XLE is down about 5% on the year now, and includes products like Exxon Mobil (XOM), Chevron (CVX), EOG Resources (EOG), and ConocoPhillips (COP).

XLP - Consumer staples

The consumer staples sector is down about 5% on the year and includes products like Proctor & Gamble (PG), Costco (COST), PepsiCo (PEP), Walmart (WMT), and Coca-Cola (KO).

XLU - Utilities

The utilities sector is the worst performing S&P 500 sector in 2023, down about 10% YTD. This sector contains companies like NextEra Energy (NEE), Southern Co (SO), Duke Energy Corp (DUK), and Sempra (SRE).

S&P 500 performance in 2023

The S&P 500 ETF (SPY) has had a stellar 2023, opening the year at $384.37 and rallying to a new all-time high of $470.10 on Dec. 13. SPY is up over 20% year-to-date, which is impressive considering the inflation, recession, and global worries we've endured through the year.

Best S&P stocks in 2023

Plenty of tech giants took off in 2023 with the artificial intelligence craze, but a few surprises made the notable performance list for the S&P 500. Here are the top five, ranked by gains:

- Nvidia (NVDA), 138%

- Meta Platforms (META), 122%

- Palo Alto Networks (PANW), 109%

- Royal Caribbean Group (RCL), 88%

- Advanced Micro Devices (AMD), 83%

Worst S&P stocks in 2023

As you might imagine, there were a handful of products that took a nose-dive during 2023. Covid vaccine products are near the top of the list. Here are the five worst performers, ranked by losses:

- Moderna (MRNA), -61%

- Enphase Energy (ENPH) - (54%)

- Dollar General (DG) - (48%)

- Pfizer (PFE) - (42%)

- Walgreens Boots Alliance (WBA) - (36%)

Stay tuned for more 2023 reviews, and 2024 outlooks on the News & Insights tab.