- The government's overspending will bankrupt future generations, Stanley Druckenmiller said.

- It's an issue that needs more attention than the debt-ceiling crisis, he said in a speech Monday.

- "The fiscal recklessness of the last decade has been like watching a horror movie unfold."

The focus on the looming debt-ceiling crisis is overshadowing a more severe cause for concern: excessive government spending.

That's according to billionaire investor Stanley Druckenmiller, who has been raising the alarm about US deficits for several years. And while he'd like the US to avoid a default, he said more attention should be given to its overspending habits.

"The fiscal recklessness of the last decade has been like watching a horror movie unfold," he said in a Monday speech at the University of Southern California, according to Bloomberg.

In a separate email to Bloomberg, he compared the debt ceiling and the fiscal spending to "worrying about whether a 30-foot wave will damage the pier when you know there's a 200-foot tsunami just 10 miles out."

Mirroring his views from a Wall Street Journal piece written in 2013, Druckenmiller repeated his warning that the spending strain will be catastrophic for future generations, with the fallout exceeding the damage seen in 2008.

Today's situation "looks much worse than I had imagined 10 years ago," he said on Monday.

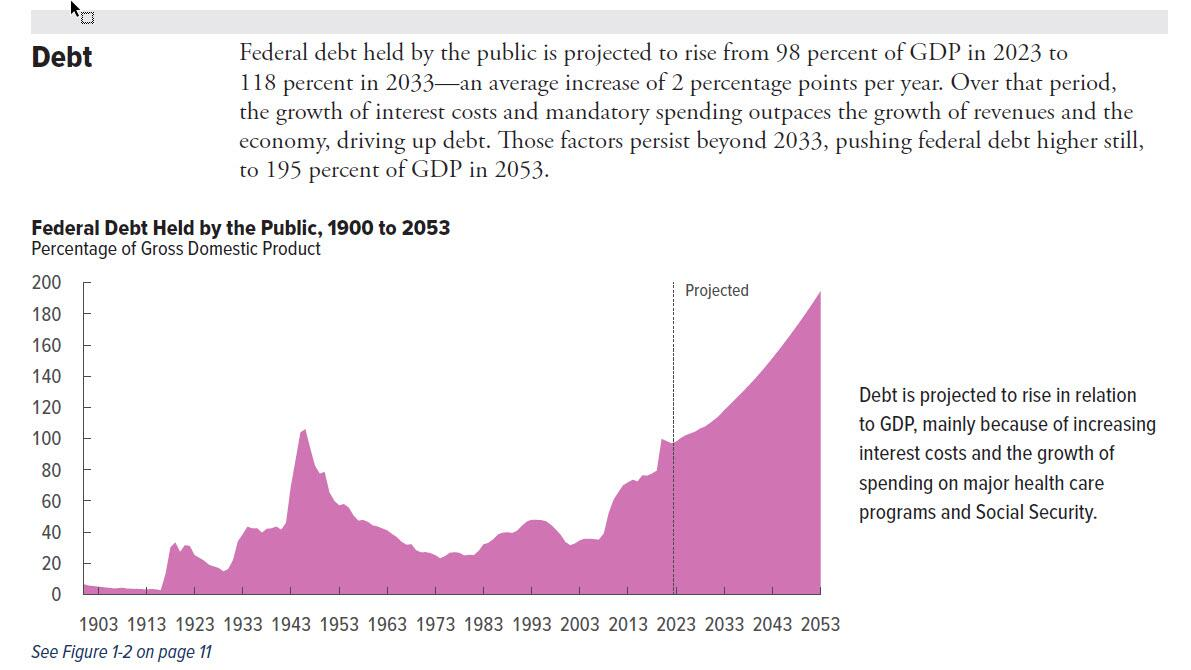

To Druckenmiller, spending on Social Security, Medicare and Medicaid will have to be cut in the future, if not today. Citing Congressional Budget Office estimates, he said that spending on seniors will account for 100% of tax revenue by 2040.

And after accounting for future entitlement payments, he estimated the actual US debt burden is closer to $200 trillion, far more than the official $31.4 trillion debt limit.

Druckenmiller also laid responsibility on the Federal Reserve, as its easy-money policies encouraged market and spending recklessness for over a decade.

And while he views the central bank's aggressive monetary tightening as a good thing, he has little faith that the Fed is devoted to the approach.

"At the first signs of trouble, the Fed last month, and in just four days, undid most of the small progress they had made in reducing their balance sheet," he said, alluding to massive liquidity in response to bank failures. "This asymmetric Fed response is what feeds the lack of serious structural action in DC from both sides of the aisle."

His comments come as congressional lawmakers are gridlocked over raising the US debt limit, and have until this summer before the nation goes into default.

On Monday, Treasury Secretary Janet Yellen said the government could run out of money and trigger an economic crisis as soon as June 1.