笨狼发牢骚

发发牢骚,解解闷,消消愁星期日晚上,期货市场开炒,原油价格又创2009年来的新低:

(点击放大)

今天一度跌破$43。

说过好多次了,油价没跌完(参见美国页岩油业生产现状简评),快到$40再来看看。

这是长期图:

在美国页岩油业生产现状简评一文里,提到现在美国产油太多,不但炼油来不及,也没地方储油了。而且美国法律目前不允许原油出口,那美国是不是即将减产了呢?结果是大家压根儿就没这打算(见下面华尔街日报报道)。油囤在美国,直接的效应是美国会减少原油进口,对国际市场增加压力,所以油价的下跌的压力还在那。

中国可以从容买入。

油价大跌 中国一天省6亿多美元?

“中国是工业大宗商品价格下跌的大赢家,以每日进口1200万桶油估算,油价下跌估计可为中国每日进口石油节省逾6亿美元,折合一年省逾2000亿美元”

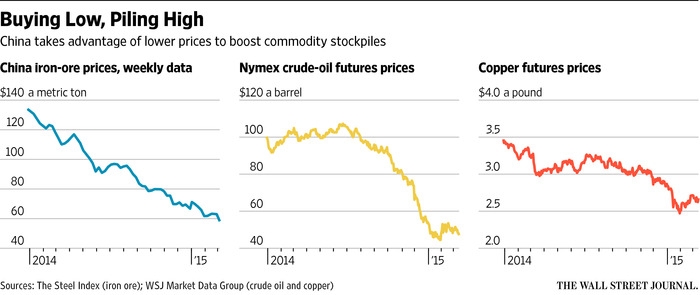

基础材料价格:

大宗商品价格暴跌 中国一年节省万亿

(同一报道,稍有些新的内容)

【后记】

尽管油价创新低,老早说过:

种种迹象视乎说明俄国经济还得恶化,卢布还得下跌。

我觉得油价还会下跌,不过卢布几个月内不会再大幅下跌。俄国经济难有起色,但触底的成数较大

(参见2014.12.27:卢布触底了?)这是周线图:

卢布尽管疲弱,但”触底“也没说错。

华尔街日报2015.03.13:U.S. Producers Ready New Oil Wave

Even as crude plummets, energy firms are waiting to unleash more supply, capping any price gains

The ocean of oil from U.S. shale drove crude prices back toward six-year lows Friday, and American energy companies say they are poised to unleash a further flood that would keep prices from returning to lofty levels for a long time.

The International Energy Agency reinforced the prospect of a prolonged slump in energy prices Friday, saying U.S. oil output was surprisingly strong in February and rapidly filling all available storage tanks. The Paris-based energy watchdog said this could lead to another sharp drop in crude prices, which fell by about 50% late last year.

The report sent oil prices tumbling around the world, with the global benchmark Brent crude falling $2.41 to $54.67 a barrel. The U.S. benchmark West Texas Intermediate lost $2.21 to settle at $44.84, less than 40 cents above a six-year low it reached in late January. Last summer, both traded well above $100.

It was only last month that the IEA said a price recovery seemed inevitable because the U.S. production boom was likely to cool. Instead, “U.S. supply so far shows precious little sign of slowing down,” the agency said Friday. “Quite to the contrary, it continues to defy expectations.”

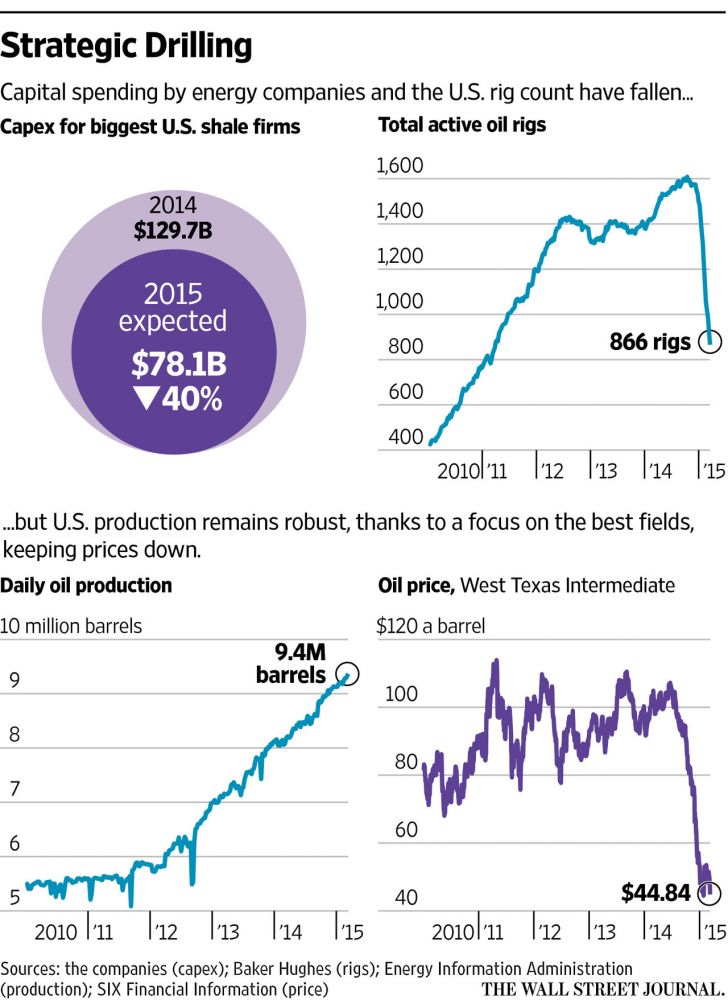

Independent shale-oil producers have slashed their planned 2015 spending on drilling by $50 billion, compared with last year’s, but have promised to increase production by focusing on their best oil fields. Total U.S. crude oil production hit a high of 9.4 million barrels a day in the week ended March 6, according to federal data.

Now many are adopting a new strategy that will allow them to pump even more crude as soon as oil prices begin to rise. They are drilling wells but holding off on hydraulic fracturing, or forcing in water and chemicals to free oil from shale formations. The delay in the start of fracking lets companies store oil in the ground in a way that enables them to tap it unusually quickly if they wish—and flood the market again.

This strategy could put a cap on how high oil prices can rise once they are recovering, said Ed Morse, global head of commodities research at Citigroup Inc.

“We’re in slightly unexplored territory,” Mr. Morse said. “It’s an experiment—a big, big experiment.”

EOG Resources Inc., an oil producer based in Texas, is drilling about 285 wells that it won’t start finishing off until crude oil’s price rebounds to between $60 and $65 a barrel.

“When oil prices recover, EOG will be prepared to resume strong double-digit oil growth,” Chief Executive Bill Thomas said recently.

Some other big names in U.S. energy also are delaying well completions, among them Anadarko Petroleum Corp., Apache Corp., Chesapeake Energy Corp. and Continental Resources Inc. These four plus EOG pumped 312 million barrels of oil in the U.S. in 2014, or almost 10% of American crude production.

The number of wells in Texas and North Dakota that have been drilled but aren’t yet pumping is at least 3,000, RBC Capital Markets estimates. That oil still in the ground “provides a war chest that could temper fundamental price spikes in the coming year,” RBC analyst Scott Hanold wrote in a Friday note.

This essentially is more U.S. crude in storage, akin to that in the tanks now brimming. The U.S. has 449 million barrels of oil sloshing around in tanks, the highest level on record and almost 70% of capacity, according to the U.S. Energy Information Administration.

Even so, Jim Krane, an energy fellow at Rice University’s Baker Institute for Public Policy, questioned whether U.S. producers would be able to adjust oil production as quickly as, for instance, Saudi Arabia has proved able to do in the past. “We’ll probably have more price volatility because even as nimble as shale is, it’s not as nimble as OPEC,” he said. The shale producers “can’t just go out and turn a valve.”

It isn’t as though the price plunge hasn’t affected production.

The number of oil rigs drilling in the U.S. declined by 56 this week to 866, a 46% drop since early October when oil was traded for about $90 a barrel, according to oilfield-service company Baker Hughes Inc. Some production cutbacks are starting to materialize.

North Dakota regulators said Thursday the state’s oil output declined 3% in January from the record level reached in December.

Market observers have been waiting for U.S. shale production to cool down since November, when Saudi Arabia said it would keep pumping oil at high levels to preserve its own customer base. Some members of the Organization of the Petroleum Exporting Countries said at the time that the move would force American producers to cut pumping because their oil is relatively expensive to produce.

U.S. companies aren’t necessarily looking to fill OPEC’s shoes as the so-called swing producer that can adjust production to help set price levels.

For many, delaying oil production from drilled wells is a financial decision; finishing off a well and putting it into service accounts for 60% of the well’s total price.

By pushing off that expense, companies hope they can earn more from higher oil prices once they finally do pump and sell their crude. They also are expecting their costs will fall as oilfield-service providers vie for their business.

Harold Hamm, chief executive of Continental Resources Inc., a producer in North Dakota, has urged peers to hold off on completing as many wells as possible.

Continental is waiting to hook up 127 already-drilled wells, postponing up to $1 million in spending apiece.

“Save that money,” Mr. Hamm said recently.

“Avoid selling that production in this poor market and wait for service costs to fall before completing those wells. Most people are doing that,” he said.